Public Provident Fund (PPF) is an investment vehicle which not only enables savings but also helps in saving tax. Any individual except non resident can make investment in PPF account. Individual can be salaried or self-employed or of any categories.

Tax Benefits of PPF:

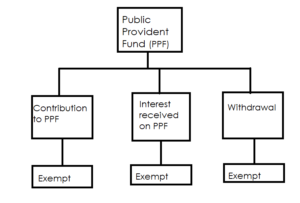

It has the status of EEE i.e. its contributions is exempt from tax, interest earned is exempt and even its withdrawal is exempt.

The amount deposited in this account can be claimed as a deduction from the Gross Total Income under section 80C at the time of filing of income tax return. Amount deposited by the individual in his own account or in the name of his/her spouse or in the account of any child is eligible for deduction under section 80C.

The interest on PPF Account is also exempted from the levy of income tax. In other words, no income tax is levied on the interest on PPF Account and this income is tax free.

No income tax is levied on withdrawal made from PPF Account.

PPF accounts are exempted from the ambit of wealth tax.

Following chart will make the picture clearer:

Who can open PPF Account?

Only a resident individual can open a PPF account. PPF account cannot be opened jointly i.e. joint ownership is not allowed.

A minor is eligible to open a PPF account with a guardian. A guardian has to be only the father or the mother (not both) or a court-appointed guardian.

Grand parents cannot open PPF account on behalf of their grandchild except in cases where both the parents have died. A person cannot open more than one account in his/her own name. However, an account opened on behalf of a minor is treated as separate.

PPF account can be opened in bank or post office. For opening PPF account one has to fill Form-A (Application for opening a Public Provident Fund Account under the Public Provident Fund Scheme 1968)

Minimum and Maximum investment:

Minimum amount required to be invested in PPF account is Rs. 500 every year and maximum amount allowed to be invested is Rs.1,50,000 every year.

Investment can be made either yearly (lump sum) or monthly but monthly investment cannot exceed 12 in a financial year.

Lock-in-period:

PPF account has a lock-in-period of 15 years. Maturity date is calculated from the end of the financial year in which account was opened. Hence a subscriber can withdraw the entire balance standing to his credit in the Fund after the expiry of a period of 15 years from the end of the year in which account was opened.

Partial withdrawal:

Even though PPF has a lock in period of 15 years, withdrawals is allowed after the expiry of a period of 5 years from the end of the year in which account was opened. Amount that can be withdrawn is upto 50% of the amount that stood to his credit at the end of the fourth year immediately preceding the year of withdrawal or at the end of the preceding year, whichever is lower, less the amount of loan, if any, which remains to be repaid. Only one withdrawal is permitted in one year. Withdrawal is to be made in Form C.

A account holder can be allowed to close his account or the account of a minor of whom he is the guardian, before maturity, on any of the following grounds namely:—

(i) that the amount is required for the treatment of serious ailments or life threatening diseases of the account holder, spouse or dependent children or parents, on production of supporting documents from competent medical authority;

(ii) that the amount is required for higher education of the account holder or the minor account holder, on production of documents and fee bills in confirmation of admission in a recognised institute of higher education in India or abroad.

Such premature closure is allowed only after the account has completed five financial years.

Moreover, a penalty of 1% reduction in interest, from the date of opening of the account till the date of such premature closure, would also be levied on the whole deposit as calculated in table shown below.

TABLE

Calculation showing the interest payable to depositor on premature closure

| Year

(1) |

Opening Balance

(2) |

Assumed Fresh Deposit

(3) |

Total Amount

(4) |

Rate of Interest

(5) |

1% less on the applicable rate of interest

(6)

|

Interest accrued

(7) |

Outstanding

Balance (8) |

| 2006-07 | 1000.00 | 1000.00 | 8.00 | 7 | 70.00 | 1070.00 | |

| 2007-08 | 1070.00 | 500.00 | 1570.00 | 8.00 | 7 | 109.90 | 1679.90 |

| 2008-09 | 1679.90 | 500.00 | 2179.90 | 8.00 | 7 | 152.59 | 2332.49 |

| 2009-10 | 2332.49 | 700.00 | 3032.49 | 8.00 | 7 | 212.27 | 3244.77 |

| 2010-11 | 3244.77 | 600.00 | 3844.77 | 8.00 | 7 | 269.13 | 4113.90 |

| 2011-12 | 4113.90 | 1000.00 | 5113.90 | 8.60 | 7.6 | 388.66 | 5502.56 |

| 2012-13 | 5502.56 | 1200.00 | 6702.56 | 8.80 | 7.8 | 522.80 | 7225.36 |

| 2013-14 | 7225.36 | 1500.00 | 8725.36 | 8.70 | 7.7 | 671.85 | 9397.21 |

| 2014-15 | 9397.21 | 1500.00 | 10897.21 | 8.70 | 7.7 | 839.09 | 11736.29 |

| 2015-16 | 11736.29 | 1000.00 | 12736.29 | 8.70 | 7.7 | 980.69 | 13716.99 |

| Total | 9500.00 | 13716.99 | |||||

Extension of Blocks:

After completion of 15 years, a subscriber has the option to extend the maturity period of the PPF account in a block of 5 years. The account can be extended for any number of years in blocks of 5 years each. However, this extension has to be taken within a year of maturity.

During the 5 year blocks, one can make withdrawal once a year. However, the amount that can be withdrawn during the five years cannot be more than 60 per cent of the balance at the start of that block.