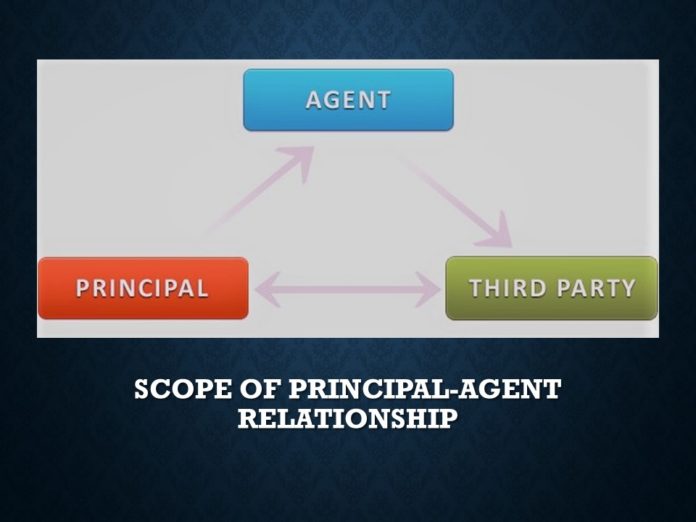

CBIC has clarified the scope of applicability of GST on supply covered under Schedule I of the CGST Act where it is specified that supply of goods by principal to agent or by agent to principal will be treated as supply even when such activity is undertaken without any consideration.

Circular No. 57/2018 – GST issued on 04.09.2018 has drawn reference to the definition of agent as per section 182 of the Indian Contract Act, 1872 and section 2(5) of the CGST Act to determine the crucial elements for covering a person in ambit of ‘agent’ and the activities carried out in principal-agent relationship.

The Circular clarifies that an activity will be bought under the ambit of schedule I only when the agent has a representative character to carry out activities on behalf of the Principal and whether or not the agent the agent has the authority to pass or receive the title of the goods on behalf of the principal.

Where the agent is supplying or receiving goods in capacity of agent and is issuing the invoices in his own name, the disclosure or non-disclosure of the name of the principal is immaterial.

Also, in such cases, the agent would be mandatorily required to be registered as per clause (vii) of section 24 of the CGST Act.